Some Known Incorrect Statements About Medicare Graham

Some Known Incorrect Statements About Medicare Graham

Blog Article

The 8-Second Trick For Medicare Graham

Table of ContentsSome Known Factual Statements About Medicare Graham Medicare Graham Things To Know Before You BuyThe 6-Second Trick For Medicare GrahamAn Unbiased View of Medicare GrahamSome Known Factual Statements About Medicare Graham The Facts About Medicare Graham RevealedThe 5-Second Trick For Medicare GrahamThe Only Guide for Medicare Graham

In 2024, this threshold was evaluated $5,030. Once you and your plan spend that quantity on Component D medications, you have actually gotten in the donut opening and will pay 25% for medications moving forward. When your out-of-pocket costs reach the second threshold of $8,000 in 2024, you are out of the donut hole, and "catastrophic protection" begins.In 2025, the donut hole will be greatly removed in favor of a $2,000 limit on out-of-pocket Part D medicine costs. Once you strike that limit, you'll pay nothing else out of pocket for the year.

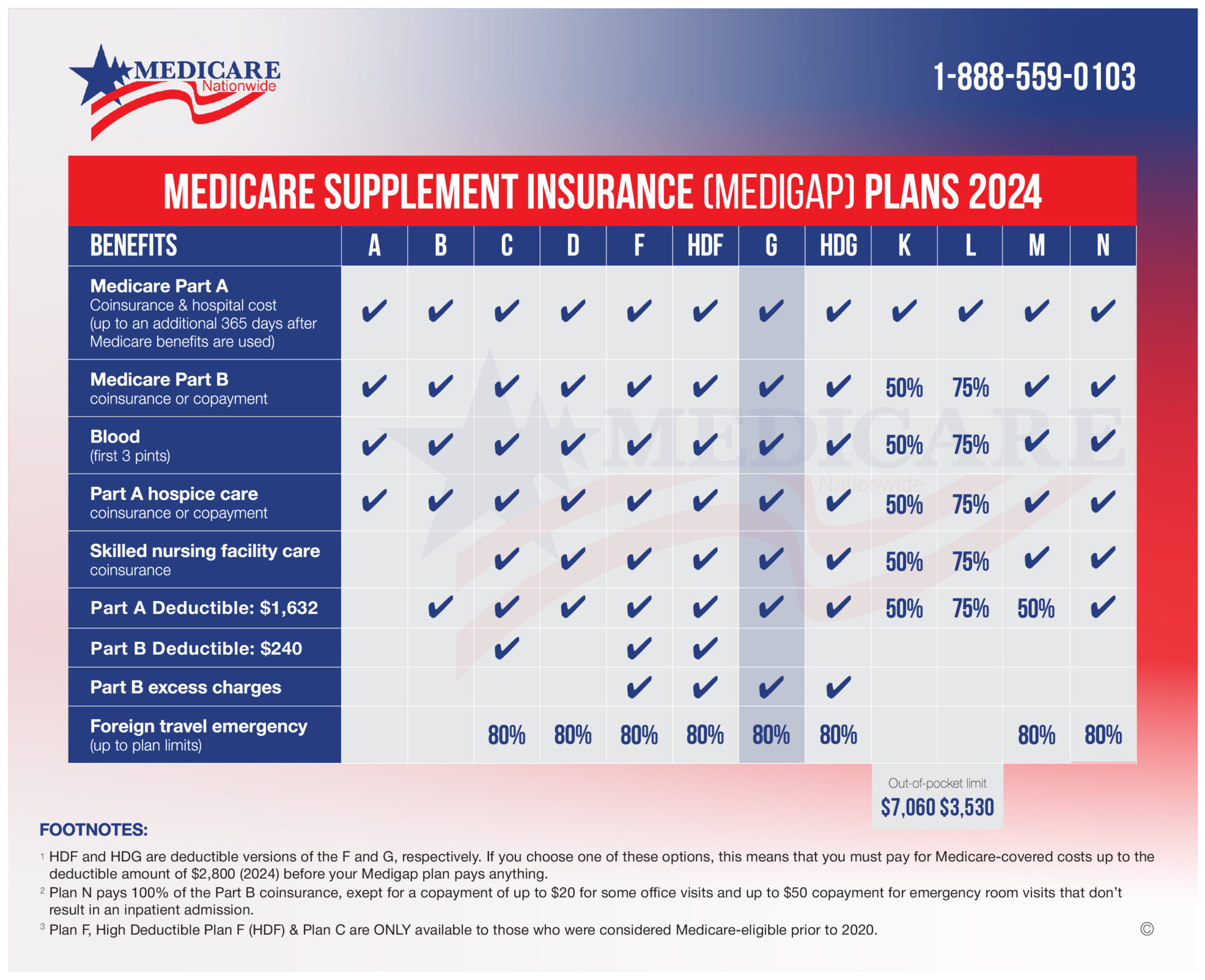

While Medicare Part C functions as an alternative to your initial Medicare strategy, Medigap collaborates with Components A and B and helps fill in any kind of protection gaps. There are a couple of essential things to know concerning Medigap. First, you have to have Medicare Components A and B before acquiring a Medigap policy, as it is a supplement to Medicare and not a stand-alone plan.

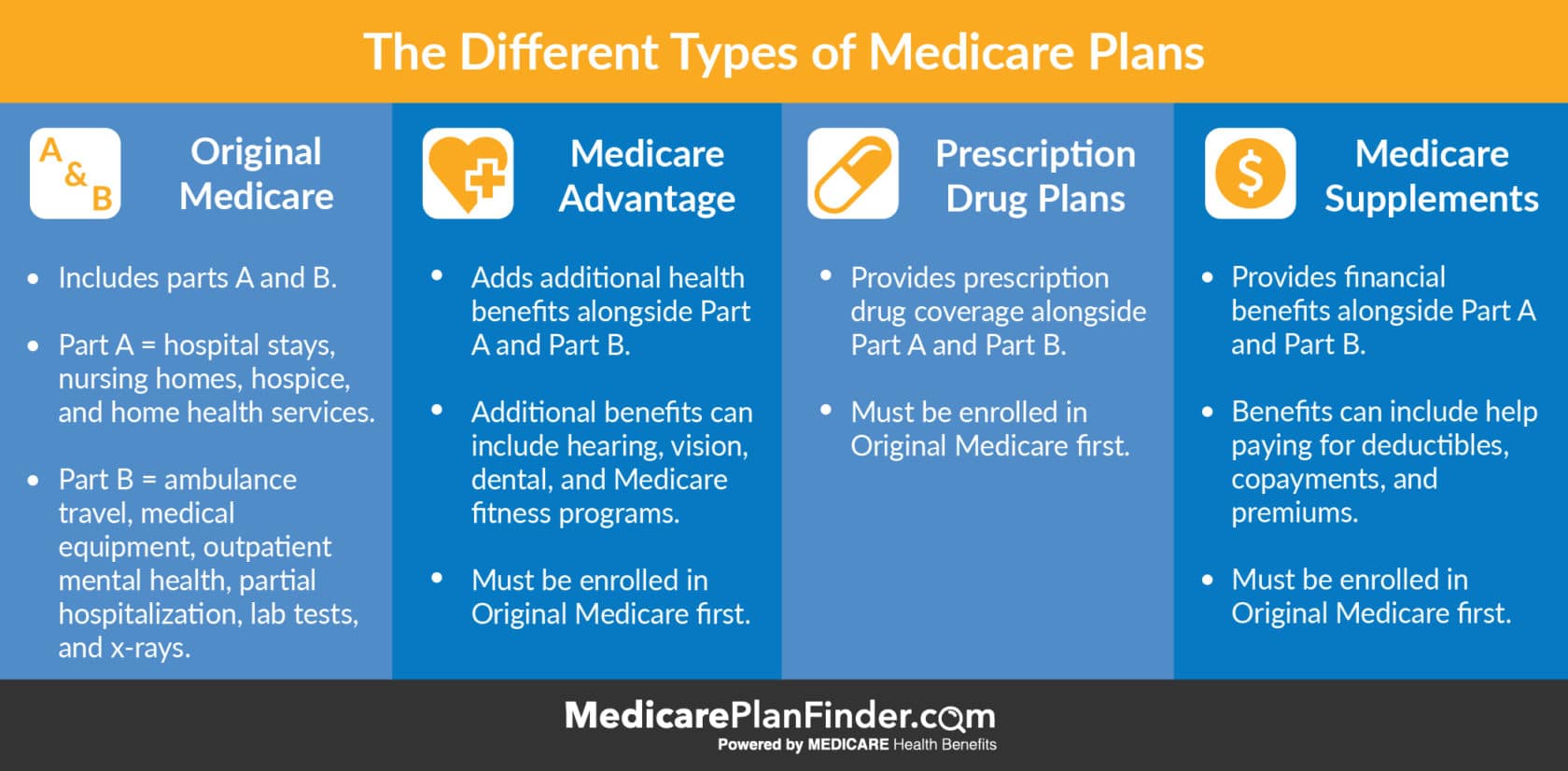

Medicare has evolved for many years and now has 4 components. If you're age 65 or older and get Social Protection, you'll automatically be enrolled partially A, which covers hospitalization costs. Parts B (outpatient solutions) and D (prescription medicine advantages) are volunteer, though under certain scenarios you may be automatically enlisted in either or both of these as well.

The Of Medicare Graham

This article describes the kinds of Medicare prepares readily available and their coverage. It likewise provides recommendations for people that look after household participants with impairments or health problems and wish to manage their Medicare events. Medicare contains 4 parts.Medicare Part A covers inpatient health center care. It likewise includes hospice treatment, knowledgeable nursing center care, and home healthcare when a person fulfills details requirements. Regular monthly premiums for those who need to.

purchase Part A are either$285 or$ 518, depending on the amount of years they or their partner have paid Medicare taxes. This optional insurance coverage calls for a month-to-month premium. Medicare Component B covers clinically needed services such as outpatient doctor check outs, diagnostic solutions , and precautionary services. Private insurance companies offer and administer these plans, however Medicare needs to approve any kind of Medicare Benefit plan prior to insurance firms can market it. These plans offer the very same coverage as components A and B, but many likewise include prescription drug insurance coverage. Regular monthly premiums for Medicare Benefit plans tend to rely on the area and the strategy a person picks. A Component D strategy's protection relies on its expense, drug formulary, and the insurance copyright. Medicare does not.

Medicare Graham Things To Know Before You Buy

commonly cover 100 %of medical costs, and a lot of strategies need an individual to fulfill an insurance deductible prior to Medicare spends for medical services. Part D commonly has an income-adjusted costs, with greater costs for those in higher income braces. This puts on both in-network and out-of-network healthcare experts. Out-of-network

Medicare Graham Things To Know Before You Buy

care incurs additional sustainsExtra For this kind of strategy, managers establish what the insurance provider spends for physician and hospital coverage click for more and what the plan owner need to pay. An individual does not require to select a primary care doctor or obtain a recommendation to see an expert.

Medigap is a single-user plan, so partners must get their very own coverage. The costs and advantages of different Medigap plans depend upon the insurance coverage firm. When it concerns valuing Medigap strategies, insurance coverage providers might use one of a number of approaches: Premiums coincide no matter age. When a person begins the plan, the insurance policy copyright elements their age right into the costs.

A Biased View of Medicare Graham

The price of Medigap prepares varies by state. As noted, rates are lower when a person buys a policy as soon as they reach the age of Medicare eligibility.

Those with a Medicare Benefit plan are disqualified for Medigap insurance. The moment may come when a Medicare strategy owner can no more make their very own choices for factors of mental or physical health. Before that time, the person needs to designate a relied on person to offer as their power of lawyer.

The person with power of lawyer can pay bills, data tax obligations, collect Social Security benefits, and pick or change healthcare strategies on behalf of the guaranteed individual.

Facts About Medicare Graham Revealed

A launch kind alerts Medicare that the guaranteed person enables the named person or team to access their medical info. Caregiving is a requiring job, and caretakers usually spend much of their time meeting the requirements of the person they are taking care of. Some programs are offered to supply (Medicare) financial support to caregivers.

military professionals or people on Medicaid, other options are available. Every state, as well as the District of Columbia, has programs that allow qualifying Medicaid receivers to handle their long-lasting care. Depending upon the private state's regulations, this may consist of working with about give care. Because each state's policies differ, those looking for caregiving settlement should look into their state's demands.

Medicare Graham Can Be Fun For Anyone

The cost of Medigap intends differs by state. As noted, prices are reduced when an individual gets a policy as soon as they get to the age of Medicare qualification.

Those with a Medicare Advantage plan are disqualified for Medigap insurance policy. The moment may come when a Medicare plan owner can no much longer make their own choices for reasons of psychological or physical wellness. Prior to that time, the individual ought to designate a trusted person to act as their power of attorney.

5 Easy Facts About Medicare Graham Explained

The person with power of attorney can pay costs, data taxes, gather Social Safety and security benefits, and choose or alter health care strategies on part of the insured person.

Caregiving is a demanding task, and caretakers usually spend much of their time fulfilling the requirements of the person they are caring for.

Report this page